Sara Swift, from Utah Central Credit Union has some tips for enjoying the holidays without going ruining the budget.

_____________________________________________

The holiday season between Thanksgiving and Christmas is one of the most financially stressful of the year.

A local Utah company that publishes an annual holiday survey said for the second year in row, the most stressful holiday activity for Utahns is spending too much money. (Source: FranklinCovey’s annual Holiday Stress Survey.)

There are still a lot of last minute shoppers out there and some are still completing their gift buying but here are some tips:

Tips

1. Don’t splurge and don’t overspend. You should never pay more than 15-20% of your take home pay on credit – and this includes all credit except home mortgages – cars, personal loans and credit cards.

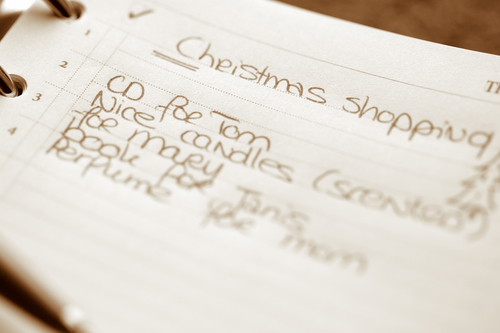

2. Sit down and make a list of the items you’ve purchased and how much they cost. You may be surprised about how much you’ve spent.

3. If you discover that you’ve left someone off you list – it may be a good time to shop because in many cases stores mark down items as much as 40%. So look for bargains.

4. Remember what the holidays are for. It‘s more about being with family and friends than blowing your budget or going into debt.

5. If you get a Christmas bonus -don’t feel tempted to blow that money now. Put it away in a rainy day or savings account.

6. If you’re out looking at the downtown holiday lights or just strolling around leave your credit cards at home so you won’t be tempted to use them. Bring cash for last minute indulgences.

________________________________________________________________

Utah Central Credit Union wants to lower the holiday stress. They are starting a holiday account for five people – so that next year when Christmas comes around you’ll already have some money set aside to spend. Just email Studio 5 at tudio5@ksl.com and UCCU will select five people randomly.

And for more information on Utah Central and their locations, you can visit them at www.utahcentral.com.

Add comment